The sales tax laws are constantly changing due to numerous letter rulings and administrative hearings occurring annually. These changes are creating new exemptions, credits and incentives and greatly impacts your bottom-line. Due to limited time and in-house resources, most companies find it impossible to track all of the legislative changes affecting their industry. Overpayments of sales tax on tax exempt items therefore go undetected and ultimately lost due to the statute of limitations.

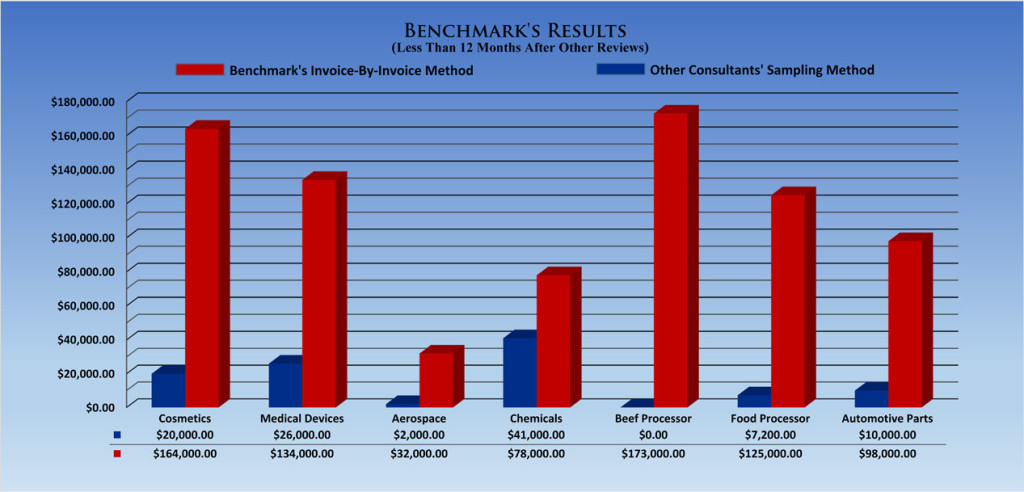

Over the past 20 years, Benchmark has achieved a 100% success rate of identifying refund opportunities through our Sales and Use Tax Reviews. Our experienced team and proven methods are the keys to our successful track record and serve as a valuable resource to our clients. Each client whether large or small benefits from the Benchmark Difference with our Invoice-By-Invoice Method. Our detailed and thorough approach looks at every invoice for every year where applicable within the statute of limitations, as opposed to the commonly used sampling approach where only a portion of invoices are reviewed. We believe our clients are interested in receiving all of their refund due and not just a portion.

The graph represents samples of Benchmark results (in red) from Reviews performed within 12 months AFTER other outside Audits (in blue) when looking at the same 48-month period. Note: this is not a complete representation of all the industries we serve.

With no out-of-pocket expense, our reviews are performed on a contingency basis with no financial risk to your company. We are so confident in the quality of our services, we back our reviews with a written Benchmark Guarantee stating we will pay you for your time if we do not identify a sales tax savings.

Overview of Our Process:

Step 1: Plant Tour

The first day of the review we have a brief initial meeting and take a brief plant tour. The plant tour is generally helpful to give our consultant a greater insight as to which areas of your operation will qualify for sales and use tax exemption.

Step 2: Accounts Payable Review

After the brief plant tour we will just need access to your accounts payable files and a place to work. We will not interfere with your daily operations and will not need any of your time or your staff’s time. Also, if your records are in a digital format we can conduct the entire review from our corporate office.

Step 3: Questions

Upon completion of reviewing accounts payable invoices, our consultant may need clarification for items on an invoice lacking adequate description. Any questions are usually handled by someone in your maintenance department that is familiar with your manufacturing equipment. The goal would be to learn the use of the items as the use will determine taxability.

Step 4: Data Entry and Client Approval

Following our on-site review, the remainder of the review is performed at our offices. Our staff performs data entry of all invoices identified during the review that qualify for sales tax exemption. Once the data entry is complete we will submit to you a detailed listing of each invoice identified with descriptions of the items and the reason they qualify for sales tax exemption.

Step 5: Filing and Recovery of Refunds

After you have reviewed and approved of our reports, we will handle 100% of all work necessary to recover your refund, including the filing, correspondence, and tracking of your refund.

Benchmark Reviews are:

- Risk-Free with no out-of-pocket expense or financial risk as we are only paid a one-time fee on a contingency basis

- Non-Invasive on daily operations as our experienced staff needs very minimal time from client personnel

- Turn-Key as we handle 100% of all work necessary to recover your refund

- Thorough as we perform an Invoice-By-Invoice Review of every year that is open within your statute of limitations

- Confidential as all of your information is held in the strictest of confidence at all times

- Guaranteed as we will pay you for your time if we do not identify you a refund